Global Response to COVID-19: Fiscal Measures and Budgeting Hurdles

In response to the COVID-19 pandemic, governments worldwide mobilized finance to mount an effective response. These significant measures, despite their imperfections in coordination and implementation, were essential in shielding both lives and economies from the worst impacts of the pandemic. However, they also uncovered deep-seated challenges in public budgeting, given the extensive economic resources needed to tackle the crisis. This article provides a comprehensive look at the magnitude of the fiscal response, the nature of these measures, and the budgeting challenges that lie ahead due to these unprecedented costs.

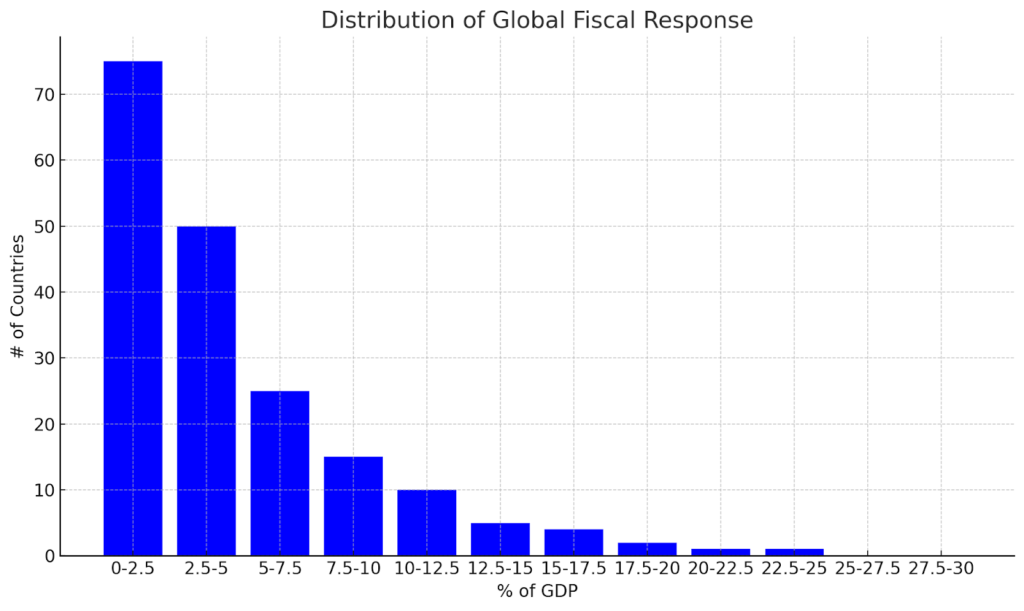

Geographical Distribution of Fiscal Responses

Around the world, governments reacted promptly to the pandemic-induced economic turmoil by unveiling substantial fiscal stimulus packages. The scale and location of these packages varied greatly, with New Zealand implementing the largest fiscal response as a percentage of its GDP among most countries, followed by Singapore, Canada, and the United States. A look at the globe reveals that approximately 70% of countries replicated similar measures worth 5% or less of their GDP. In the African continent, Lesotho led the way, while in Europe and South America, the United Kingdom and Chile launched the biggest fiscal responses, respectively.

Components of the Fiscal Response

The fiscal response to COVID-19 was based on three main pillars: mitigation of taxes and fees, incentives for employment protection, and economic stimulus.

Taxes and fees relief

In an attempt to lighten the financial burden on individuals and enterprises, most governments extended tax filing deadlines and lowered tax rates. Other policies implemented were:

- Deferral of tax installment payments and waiver of interest on late payments;

- Extension of payroll tax exemptions and deferral of sales tax remittances;

- Suspension of increments in government fees and charges;

- Augmentation of corporate tax thresholds and rebates;

- Elimination of import tariffs on essential medical supplies.

Employment incentives

Businesses were provided with funds to support payroll, while unemployment benefits were increased to safeguard individuals who lost their jobs due to pandemic-related layoffs. Policies to bolster employment included:

- Expansion of unemployment insurance coverage and benefits;

- Provision of wage subsidies to adversely affected businesses;

- Suspension of mandatory employer contribution to pension funds;

- Delivery of income support to informal workers and other vulnerable groups;

- Introduction of traineeships and skills training for public and private sector jobs.

Economic stimulus

Direct payments were made to individuals and loans offered to businesses severely impacted by COVID lockdowns, in an effort to sustain consumption spending and prevent economic collapse. Measures to stimulate the economy encompassed:

- Support of industries including aviation, tourism, food service, retail, energy;

- Provision of credit lines for enterprises of different scales;

- Co-investment in new businesses with private investors;

- Reduction of rent for informal markets and small businesses;

- Refinancing of existing loans and payments for small businesses.

Budgeting Challenges in the Post-COVID Era

The implementation of these measures, though necessary, brought several budgeting challenges to the fore. Policymakers struggled with planning in the face of uncertainty, as previous assumptions and forecasts lost their relevance. The varying trajectory of the pandemic and associated restrictions influence additional spending needs and revenue predictions. Moreover, transparency in the budget-making process has become even more crucial given the large expenditures on the pandemic response. Policymakers must also devise strategies to create ‘fiscal space’ as emergency expenditures during the pandemic led to steep increases in fiscal deficits globally.

Potential Strategies to Overcome Budgeting Challenges

Governments are under pressure to navigate these challenges by considering multiple scenarios, continual revisions of budget documents, and ensuring legislative oversight and public engagement. However, strategies on both the expenditure and revenue sides are needed to create fiscal space.

Expenditure-side Strategies

COVID-related spending and debt repayment obligations present expenditure-side pressures. Governments can approach lending institutions to restructure existing debt and negotiate deferment of loan repayments. Measures to reduce operational expenses, reprioritize capital expenditures, and enact structural changes such as pension reforms are also essential.

Revenue-side Strategies

Challenges on the revenue front stem from dips in tax and natural resource incomes. Authorities have the option to approach entities such as the IMF for borrowing opportunities, which serve not only as direct financial injections but also as a means to attract additional funds from capital markets. Pursuing strategies like the monetization of assets and revamping tax systems can also be instrumental in generating extra revenue.

Immediate Impacts and Long-term Consequences of Budgeting Decisions

Grasping the immediate and foreseeable extended effects of fiscal decisions is vital. In the near term, these financial strategies have thrown a crucial lifeline to countless enterprises and family units, averting a nosedive in the economy and limiting the escalation of poverty. Nonetheless, the accumulating state debts might overshadow the prospects of coming generations, possibly resulting in reduced government expenditure and increased taxation.

Conclusion

The COVID-19 pandemic has shown the difficulties in public finance and budgeting, with governments facing increased costs and limited revenues while trying to protect their populations and economies. This situation requires policymakers and financial experts to find a balance between immediate responses and long-term economic stability, emphasizing openness, adaptability, and careful spending.

As governments navigate fiscal challenges brought by the pandemic, including significant relief measures, there’s a chance to implement strategies that ensure both immediate support and future financial health. Moving forward, careful fiscal planning, budget transparency, and thorough strategies for revenue and spending will be essential for economic recovery and resilience.